- Home

- Tally PRO Vol.2

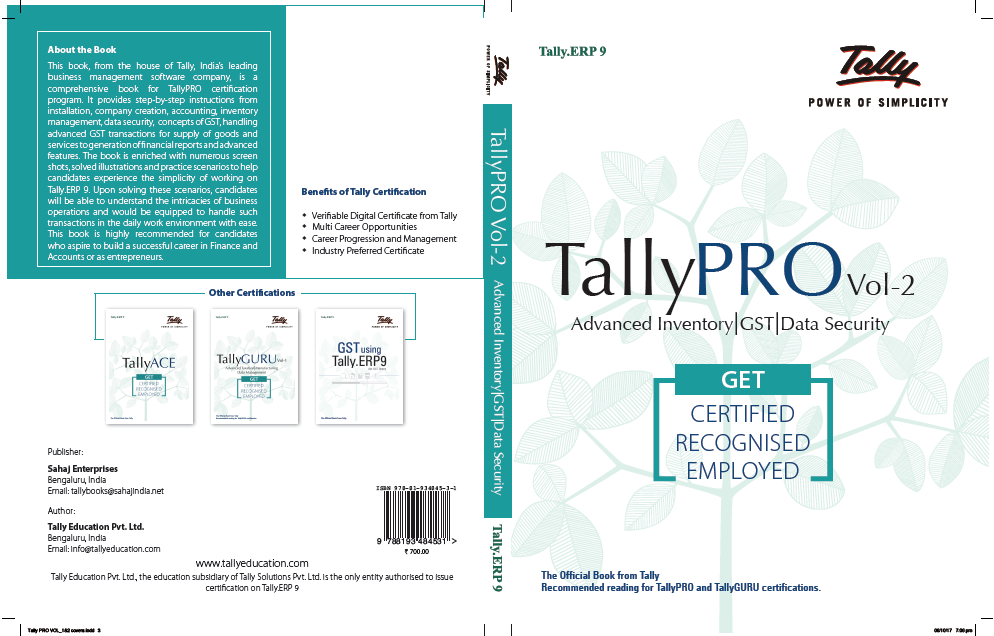

Tally PRO Vol.2

The Tally PRO vol 2 is from the house of Tally, India’s leading business management software company. This Tally PRO book is a comprehensive book for Tally PRO certification program. It has step-by-step easy instructions from installation, company creation, accounting, inventory management, data security, concepts of GST, handling advanced GST transactions for supply of goods and services to generation of financial reports and advanced features. The Tally PRO book is enriched with many screen shots, solved illustrations and practice scenarios to help candidates experience the simplicity of working on Tally.ERP 9. Upon solving these scenarios, candidates will be able to understand the intricacies of business operations and would be equipped to handle such transactions in the daily work environment with ease. The Tally PRO vol 2 is highly recommended for those candidates who aspire to build a successful career in Finance and Accounts or as entrepreneurs.

Features

- Author : Tally Education Pvt. Ltd.

- Language : English

- Binding : Paperback

- Publisher : Sahaj Enterprises

- ISBN : 978-81-934845-3-1

- Year of Publishing : 2019

- Pages : 377

- Dimension : 28 X 20.5 X 1.5 cm

Table of Content

- 1.1 Introduction

- 1.2 Godown Management

- 1.2.1 Activating Godown

- 1.2.2 Creating a Godown

- 1.2.3 Allocation of Stock to Particular Godown while Defining Opening Balance

- 1.2.4 Recording of Purchase, Sales and Stock Transfers with Godown Details

- 1.2.4.1 Purchase of Inventory

- 1.2.4.2 Recording stock transfer entry using stock journal

- 1.2.4.3 Sale of Inventory

- 1.2.5 Maintaining Damaged Goods

- 1.2.6 Analysing Godown Summary and Stock Movement Reports

- 1.3 Stock Category

- 1.3.1 Activation of Stock Categories

- 1.3.2 Creating Stock Categories

- 1.3.3 Recording of Transactions

- 1.4 Movements of Goods in Batches/Lots - Batch wise details

- 1.4.1 Activating Batch-wise Details in Tally.ERP 9

- 1.4.2 Using Batch-wise Details in Purchase Invoice

- 1.4.3 Using Batch-wise Details in Sales Invoice

- 1.4.4 Expired Batch/Stock Transfer

- 1.4.5 Batch Reports

- 1.4.5.1 Batch Vouchers Report

- 1.4.5.2 Batch Summary Report

- 1.4.5.3 Transfer Analysis report

- 1.5 Stock Valuation Methods

- 1.5.1 Configuration of Stock Valuation Method

- 1.5.2 Different Types of Costing Methods

- 1.5.3 Recording of Purchase and Sales Transactions

- 1.5.4 Stock Valuation based on FIFO Perpetual Method

- Key Takeaways

- Shortcut Keys

- Practice Exercises

- 2.1 Introduction

- 2.2 Purchase Order Processing

- 2.2.1 Activating Order Processing in Tally.ERP 9

- 2.3 Sales Order Processing

- 2.4 Viewing Order Details

- 2.5 Display Columnar Orders & Stock Details

- 2.6 Sales order outstanding

- 2.7 Pre-closure of Order

- 2.8 Reorder Level

- 2.9 Display Reorder Status

- Key Takeaways

- Shortcut Keys

- Practice Exercises

- 3.1 Introduction

- 3.2 Activating Price Lists and Defining of Price Levels

- 3.2.1 Creation of Price List

- 3.2.2 Using Price List

- 3.3 Revise Price List

- Key Takeaways

- Shortcut Keys

- Practice Exercises

- 4.1 Introduction

- 4.2 Activating of Bill of Materials

- 4.3 Auto Listing of Components Using Bill of Materials

- 4.4 Accounting of Manufacturing Process in Tally.ERP 9

- 4.5 Transferring of Manufactured Goods from Storehouse to Showroom

- 4.6 Reports

- 4.6.1 Stock Journal Register

- 4.6.2 Transfer Analysis

- 4.6.3 Cost Estimation

- 4.6.4 Stock Ageing Analysis

- Key Takeaways

- Shortcut Keys

- Practice Exercises

- 5.1 Introduction

- 5.2 Enabling GST and Defining Tax Details

- 5.3 Transferring Input Tax Credit to GST

- 5.4 Intrastate Supply of Goods

- 5.4.1 Intrastate Inward Supply

- 5.4.2 Intrastate Outward Supply

- 5.5 Interstate Supply of Goods

- 5.5.1 Interstate Inward Supply

- 5.5.2 Interstate Outward Supply

- 5.6 Return of Goods

- 5.6.1 Purchase Returns

- 5.6.2 Sales Returns

- 5.7 Supplies Inclusive of Tax

- 5.8 Defining Tax Rates at Master and Transaction Levels

- 5.8.1 Defining GST Rates at Stock Group Level

- 5.8.2 Defining GST Rates at Stock Item Level

- 5.8.3 Defining GST Rate at Transaction Level

- 5.8.4 Hierarchy of Applying Tax Rate Details

- 5.9 GST Reports

- 5.9.1 Generating GSTR-1 Report in Tally.ERP 9

- 5.9.2 Generating GSTR-2 Report in Tally.ERP 9

- 5.10 Input Tax Credit Set Off

- 5.11 GST Tax Payment

- 5.11.1 Timeline for payment of GST

- 5.11.2 Modes of Payment

- 5.11.3 Challan Reconciliation

- 5.12 Exporting GSTR-1 return and uploading in GST portal

- 5.13 Recording Advanced Entries

- 5.13.1 Purchase from Composite dealer

- 5.13.2 Exports

- 5.13.2.1 Exports through LUT/Bond

- 5.13.2.2 Exports Taxable

- 5.13.3 Exempted Goods

- 5.13.4 SEZ Sales

- 5.14 Accounting Reverse Charge under GST

- 5.15 Accounting of Supply of Services

- 5.16 Accounting Exempted Services

- Key Takeaways

- Shortcut Keys

- Practice Exercises

- 6.1 Introduction

- 6.2 Basic Concepts of TDS

- 6.3 TDS Process

- 6.4 TDS in Tally.ERP 9

- 6.5 Activation of TDS Feature in Tally.ERP 9

- 6.6 TDS Statutory Masters

- 6.7 Configuring TDS at Group Level

- 6.8 Configuring TDS at Ledger Level

- 6.9 Booking of Expenses in Purchase Voucher

- 6.10 Recording Transactions

- 6.10.1 0Expenses Partly Subject to TDS

- 6.10.2 0Booking Expenses and Deducting TDS Later

- 6.10.3 0Accounting Multiple Expenses and Deducting TDS Later

- 6.10.4 0Accounting for TDS on Advance Payments against Transport

- 6.10.5 0TDS on Expenses at Lower Rate

- 6.10.6 0TDS on Expenses at Zero Rate

- 6.10.7 0Deducting TDS on Payments

- 6.10.8 0Reversal of Expenses with TDS

- 6.10.9 0Deducting TDS on Expenses with Inventory

- 6.10.10 Accounting TDS on Fixed Assets

- 6.10.11 Payment of TDS

- 6.11 TDS Reports

- 6.11.1 Challan Reconciliation

- 6.11.2 TDS Outstandings

- 6.11.3 E-Return

- Key Takeaways

- Shortcut Keys

- Practice Exercises

- 7.1 Introduction

- 7.2 Security Control

- 7.3 Activation of Security Control and Creation of Security Levels in Tally.ERP 9

- 7.4 Accessing the Company with Data Operator’s User Account

- 7.5 Password Policy

- 7.6 TallyVault Password

- 7.6.1 Activation of TallyVault in Tally.ERP 9

- 7.6.2 Configuration of TallyVault Password while Creating the Company

- 7.6.3 Configuration of TallyVault Password for Existing Company

- 7.6.4 Benefits of TallyVault Password

- Key Takeaways

- Practice Exercises

- 8.1 Introduction

- 8.2 Backup and Restore

- 8.2.1 .....Backup of Data

- 8.2.2 .....Restoring Data from a Backup File

- 8.3 Export and Import of Data

- 8.4 Exporting and Importing of Data from One Company to Another in XML Format

- 8.4.1 Exporting of Masters from One Company to Another

- 8.4.2 Importing of Masters from One Company to Another

- 8.4.2 Importing of Masters from One Company to Another

- 8.5.1 Exporting of Reports in Excel

- 8.5.2 Exporting of reports in PDF Formats

- 8.6 E-Mailing in Tally.ERP 9

- 8.6.1 E-mailing a Report

- 8.6.2 Mass Mailing

- 8.7 Printing Reports

- 8.7.1 Printing the Balance Sheet

- 8.7.2 Printing Profit & Loss Account

- 8.7.3 Printing of Confirmation of Accounts

- 8.7.4 Printing of Sales Invoice

- 8.7.5 Printing of Company Logo

- 8.7.6 Printing of company logo on Sales Invoice

- 8.7.7 Printing of company logo on Reports

- 8.8 Managing of Data during Financial Year End Process

- 8.8.1 Important Pre-Split Activity

- 8.8.2 Splitting of Data

- Key Takeaways

- Shortcut Keys

- Practice Exercises

- Key Answers

- Annexure